The demand for a great customer experience (CX) is ever-growing. This means providing fast, convenient services that help customers achieve their goals is the only way to succeed and remain competitive.

This is the expectation across industries, including the insurance industry. Unfortunately, an IBM report shows that 60% of insurers lack a customer experience (CX) strategy. This may be one reason why 42% of customers don’t fully trust their insurer.

Without a solid CX plan and the tools to execute it, you’ll fall behind the competition. This is especially crucial to note because 40% of insurers are already putting some semblance of a CX strategy into motion.

In this guide, we’ll describe some customer experience trends du jour as well as how you can use them—and AI—to exceed customer expectations as an insurance company.

The top customer experience challenges in the insurance industry

Why does the insurance industry consistently struggle to deliver positive customer experiences? A big part of this problem has to do with complacency. In the past, insurers didn’t need their customers to like them because their services were a necessity.

In order to beat competitors, all insurance companies needed to do was offer the best rates and packages. However, the situation today is quite different: Consumers want great customer experiences with every single company they do business with.

Even insurance executives are taking notice, with 95% stating the claims experience is key to maintaining customer loyalty.

Unfortunately, this area and several others need work across the board, with many of today’s insurance companies merely playing catch-up.

Here’s a look at the leading challenges the insurance industry faces with CX:

- Understanding the customer’s needs and desires

- Developing an omnichannel sales process for a cohesive experience

- Using IoT to improve customer personalization

- Building apps and websites that cater to customers’ needs

- Improving the customer experience as demands change

If these are common problems that you face within your organization, be sure to read through to the following CX trends in insurance technology.

Digital insurance customer experience trends in 2022

Insurance providers are taking the customer experience seriously in 2022. In the same IBM report mentioned above, researchers reveal that 90% of insurers have a Chief CX or Chief Customer Officer (CCO) to drive customer success.

This is a smart move because the IBM survey shows 60% of consumers want their insurers to understand them well. To achieve this, insurance companies must gather the right intel to learn the needs and desires of customers.

Given that customers rarely engage with their insurers, it’s critical to make every call and interaction a great one. One hiccup can lead to a lost customer for life!

In that case, what can you do to prevent subpar customer interactions? Below are some of what others in the insurance industry are doing to improve their CX.

1. Focusing on omnichannel.

Digital transformation allows customers to engage with insurers everywhere—on social media, over email, on the phone, and via online chat. Some even have apps to file claims or speak to representatives.

One report shows 45% of customers use three or more channels to get support from their insurance provider. Based on this fact, it’s critical to have an omnichannel strategy in place.

But before you build one, it’s vital to learn about your customers. With a mix of artificial intelligence and human representatives, you can gather information from customers to improve their omnichannel experiences.

For example, you can use a tool that records and transcribes customers’ calls; afterward, the tool analyzes communications to identify keywords and trends that signal issues in the omnichannel experience.

Maybe you’ll learn that customers prefer to use specific channels, or that your social media isn’t connected to your CRM. This would mean that the omnichannel experience is broken.

Use the data you gather to map out customer journeys, then ensure your omnichannel strategy is accepted across departments.

2. Simple purchasing experiences.

Being onboarded into a clunky, disorganized, or complex process isn’t an ideal customer experience. Unfortunately it’s the all-too-common reality for insurers who rely on paperwork or digital forms to educate customers about their policies.

What insurers are left with are dissatisfied and confused customers. According to the 2021 Global Insurance Outlook report out of EY, 63% of customers don’t understand the parameters of their life insurance coverage. Another 50% aren’t confident they’ll get the benefits included in their coverage.

What this demonstrates is poor communication. One can pick up on these issues if one takes the time to interview customers throughout and following the onboarding process.

Have representatives record these interviews to gain insights into the frustrations created during and after the purchase. Then, use these insights to train sales and support teams to provide better answers for asked and anticipated questions.

Or, better yet, build a knowledge base that answers concerns customers have so they have a self-service resource.

3. Enhancing the claims process.

The claims process is the most important part of the customer’s journey. If you want to gain loyal customers, perfecting this process is key.

The best way to do this is simply to listen to your customers. Interview them about their claims experience and record claims calls. Both will unveil details that shine a light on overseen issues.

For example, maybe there’s not enough empathy or personalization. People want to feel their insurer understands what they’re going through, particularly after a tragedy.

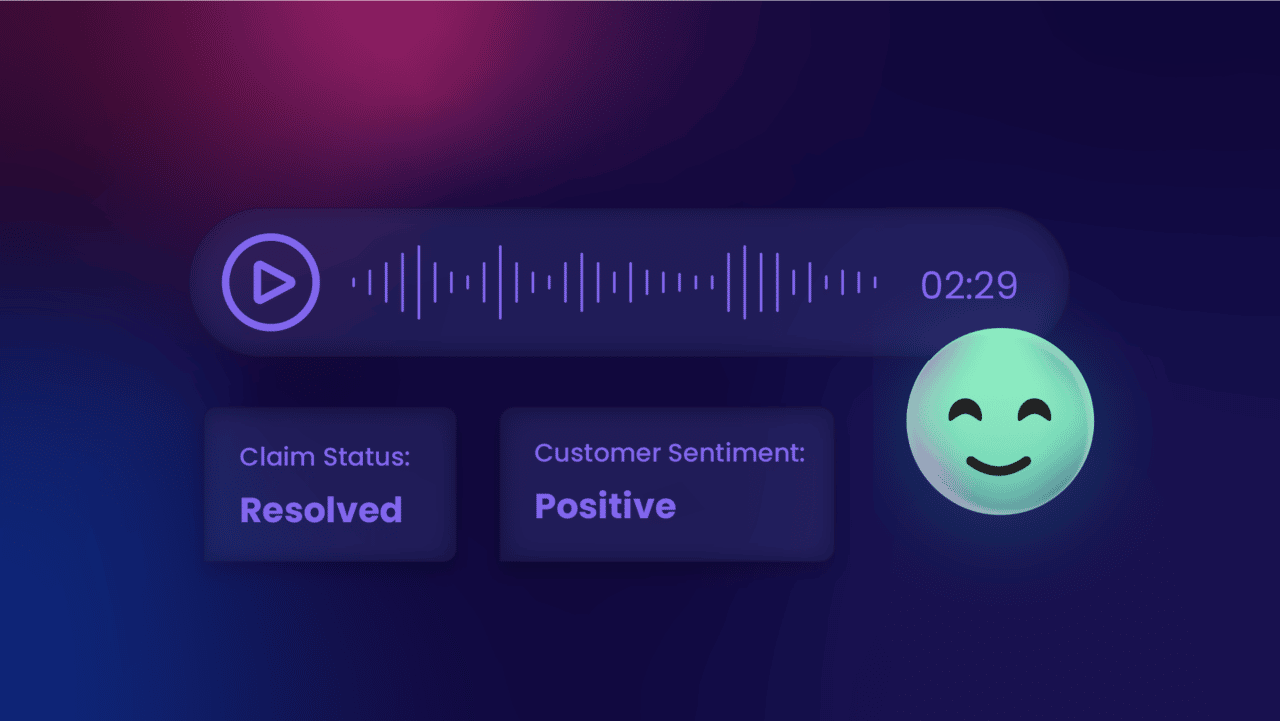

With an AI-powered transcription tool, you can record claims calls to identify the sentiment of representatives. If you see they’re not showing empathy, then train them to do so.

When a customer calls to file a claim, odds are they’re emotionally charged and sporadic. So, it’s critical that your support team is capable of being empathetic. Use recorded calls to identify specific problems to use as examples of what not to do in the future.

Then, you can build a training program to ensure all future representatives understand how to manage high-emotion claims calls.

4. Creating personalized customer experiences.

Your customers don’t just want you to understand them, they want you to know them well–or at least, that’s what 64% of consumers said in the IBM survey.

How do you achieve this? By collecting and analyzing customer data and using it to build a personalized experience.

Conversation AI provides real-time insights (e.g., sentiment, topics, follow-ups) so that sales reps can instantly leverage them to enhance the customer experience.

If your conversation data shows that the customer recently downgraded their vehicle to save on gas, and mentions on a support call about losing their job, you can offer them a discount for being eco-friendly. Or, you can offer to search for a better policy rate to prevent losing them as a customer.

Deliver a better customer experience with voice AI

Customers rely on insurance companies to bail them out of financial hardships. But doing the bare minimum (e.g., paying for expenses) isn’t enough.

If you’re not proactively perfecting the customer experience, then you’ll fall behind the competition.

Conversation AI has never been more important than now—especially with 36% of leaders stating insurance customers prefer the phone over other channels to buy policies.

With Symbl.ai, you can transcribe and analyze all communications, including phone, email, and online chat. Then, you can capture these insights and plug them into a hub or shared CRM for sales and support teams to easily view.

Symbl.ai is a context-aware conversation AI tool with monitoring dashboards that show the sentiment of representatives and customers in real time, so your teams can better manage their tone and create a better overall communication experience.

The real-time analysis Symbl.ai offers makes it easier to solve problems right away to prevent customer dissatisfaction and churn.

Curious to see it in action? Talk to an expert to better understand how Symbl.ai can amplify your customer experience today.